[Interview] Future importance of Hydrogen & Power-to-X in industrial applications at the EU level

Welcome to today’s interview! It features an insightful conversation I had with Dr. Carola Kantz, deputy managing director and a valuable member of the VDMA “Power-to-X for Applications,” on the future importance of hydrogen and Power-to-X (P2X) in industrial applications at the EU level.

The topic breaks down into four chapters to reach the core areas of interest with enhanced determination:

I. Part: >> Hydrogen in the context of Power-to-X <<

II. Part: >> Legislations for climate protection <<

III. Part: >> Building a hydrogen economy <<

IV. Part: >> Involvement of the mechanical & plant engineering sector <<

Dr. Carola Kantz

Dr. Carola Kantz is the deputy managing director of the VDMA platform Power-to-X for Applications. The platform represents the entire value chain of Power-to-X, from renewable energies to process engineering and applications. Before moving to her current post, she coordinated the VDMA activities in the energy sector in Berlin. Prior to this, she worked as consultant on sustainability, energy and mobility issues in Berlin and London. She holds a doctorate from the London School of Economics (LSE) and studied political science and economics in Munich, Lausanne and Heidelberg.

I. PART

Hydrogen in the context of Power-to-X

Over the past decade, hydrogen emerged among the preferred carriers in P2X applications to convert renewable electricity into a storable energy carrier. The staggering potential to favor carbon-neutral tendencies across industrial sectors in the face of climate change provided the perfect background to have an inciting tête-à-tête for the contextualization of hydrogen, as a whole, in the budding Power-to-X industry. No question was off-limits. So, starting with basics such as the significance of the different hydrogen types to applications was the naturally the first step to board.

Dr. Kantz, after having realized that not all hydrogen is the same - at least in global climate terms. Can you explain what’s behind the distinctive hydrogen colour code?

Certainly! And thanks for opening a window of opportunity to increase awareness of hydrogen’s importance for the EU’s energetic future.

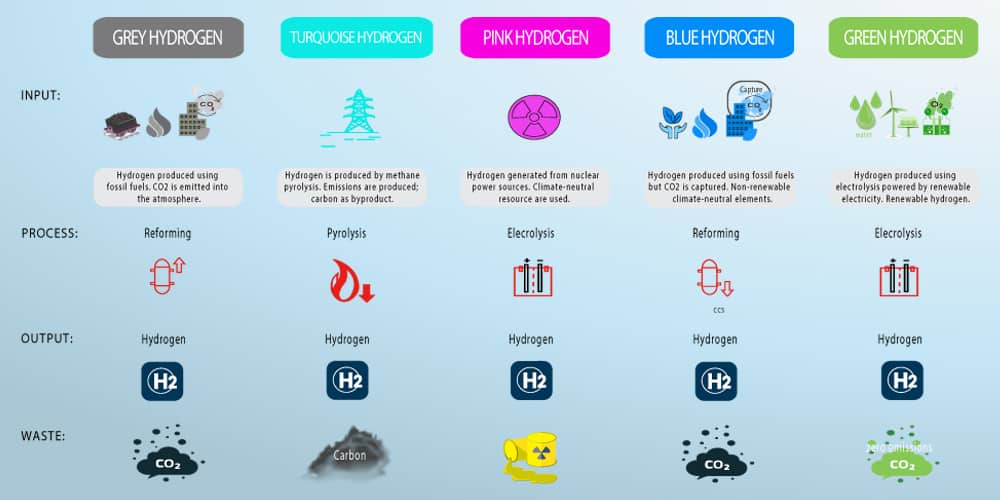

Hydrogen has assigned colours related to its production source and CO2-performance. The colour code—also called colour theory in the hydrogen world—is a resort to inform on CO2 emissions, the type of storage, and whether or not it is climate-neutral or renewable.

How do these colours relate to the production method?

Colour theory classifies hydrogen into five colours.

Gray hydrogen is the classic kind that most are familiar with and see in common use. Gray hydrogen’s production is derived from fossil fuel—natural gas or coal—steam reforming. During the hydrogen generation process, CO2 is released directly into the atmosphere.

Then, there is the so-called blue hydrogen. Much like gray hydrogen, the production process takes place in a steam reduction facility where natural gas splits it into hydrogen and CO2. Throughout, carbon dioxide is not emitted into the atmosphere. Instead, it is stored or processed industrially, a variant that catalogs blue hydrogen as a non-renewable climate-neutral element.

The latest introductions to the colour-coded hydrogen system are green, turquoise, and pink.

Green hydrogen is the product we want to get to. An element that’s fully supported by renewable energy sources, like wind power, hydroelectric power, or solar power. The production of green hydrogen must have a renewable power generation plant that enables water decomposition by electrolysis in a CO2-neutral way.

At the European level, green hydrogen is also called renewable hydrogen. The hydrogen variant to have in the climate-neutral world.

Regarding turquoise hydrogen, it can be said that it is still a novel development. In this natural gas-based process, hydrogen is produced by methane pyrolysis. Methane pyrolysis is a thermal process that splits natural gas into hydrogen and solid carbon. The residual solid carbon is eligible for storage.

It is important to state that turquoise hydrogen is not completely climate-neutral because, during the extraction of the starting material, natural gas often produces emissions as does the further processing of the by-product carbon.

VDMA is eagerly waiting to see how far the turquoise hydrogen technology progresses in the near future. Current developments are not yet ready for the market.

At last, there is pink hydrogen—often called yellow hydrogen—, a climate-neutral resource that is generated from nuclear power sources. Given the existing issues of nuclear power technology, the sustainability of pink hydrogen is often up for discussion not only across Germany but in Europe. So, it is wise to start getting used to the idea of European Union countries, such as France, taking advantage of this arising opportunity.

What role does green hydrogen play in the context of Power-to-X?

There are a couple of key things to comprehend:

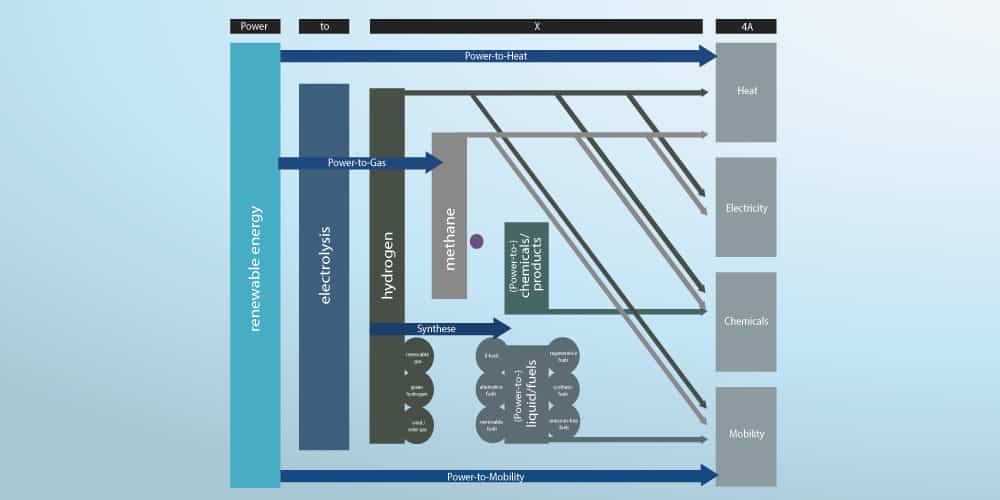

The first one is that hydrogen can be a ready-for-use energy carrier deployed in many services. For example, fuel cells in the steel sector; direct hydrogen reduction, or power generation in gas-fired power plants. In each application as an energy carrier, hydrogen offers users both, direct availability and direct use.

Secondly, hydrogen has the capability to convert into other energy carriers. There lies the importance of its offering!

Hydrogen brings a multitude of energy carriers that can be developed by VDMA members under Power-to-X! An exciting menu of possibilities that is especially open for exploration in Germany.

Can you expand on the other energy forms derived from hydrogen in Power-to-X?

As you know, the “X” in P2X stands for a variety of different energy sources. Through hydrogen, industries can access new, green production options. For example,

- Green ammonia. Ammonia is a leading feedstock used today in fertilizer production,

- Green methane, and

- Green liquid fuels, such as diesel, gasoline, and synthetic kerosene. All fit for use in aviation and shipping.

In the industry, all these energy carriers are subsumed under the technical term Power-to-X. By the way, these energy carriers are also called hydrogen derivatives.

In each example, hydrogen is the most important product needed for conversion. Nitrogen or CO2 can be added too, accordingly. By means of certain processes, such as the Fischer-Tropsch, the various energy carriers are then produced. Yet, they are always backed by green hydrogen. Consequently, every Power-to-X process starts with hydrogen conversion.

Source: Illustration of power-to-X processes, products and applications; © WZB

Dr. Kantz, the VDMA network is now called Power-to-X for Applications and not just Power-To-Hydrogen for Applications. To what extent does green hydrogen play a role in your strategic orientation and daily doings?

As I said before, hydrogen is the starting point for all the other derivatives that you can make from it. Hence, it became a natural path for VDMA to unify the whole value chain under a single working group that developed sound answers to the pressing challenges of today and the future.

Looking at the value chain, you see plant manufacturers in the field of renewable energies, process engineers working in electrolysis, process engineering teams in downstream operations (such as the Fischer-Tropsch), and, at last, the applications themselves.

VDMA “Power-to-X for Applications” (P2X4A) puts great effort into building a solid value chain. So, great potential lies ahead for mechanical and plant engineering integration regardless of hydrogen deployment, whether it is used directly or converted into other energy sources. Such a scenario will enlarge the value chain, adding more components and application requirements to look after. Yet, it also creates an inclusive space where more companies get to participate in the new hydrogen economy.

VDMA focuses on championing hydrogen as a leading player for the applications to accomplish the main goal of decarbonizing sectors (e.g., shipbuilding and aviation, chemicals, steel). In parallel, mechanical and plant engineering teams stay informed about companies’ standings, highlighting specific competencies and positions as component manufacturers.

The VDMA P2X4A also raises attention to causes that demand political awareness. Such as the fact that developing hydrogen is not enough to cut the value chain. Reaching that target is possible if other energy carriers (hydrogen derivatives) are part of the solution too. The P2X4A team provides extensive support in this area.

We aspire to increase and strengthen the opportunities of VDMA member companies. Some of them are now in a transformation process because certain technologies are expected to disappear by 2050 or will have to undergo thorough changes. In other cases, they have to wait in line until new products suitable for hydrogen use to get developed.

II. PART

Legislations for climate protection

Ever since the Paris Agreement and EU legislation—like the Fit for 55 Package—became legally binding treaties on climate change, engineers encountered a tremendous challenge to resolve under the countdown of an hourglass. Dr. Kantz shared views on the matter, anticipating what to expect from P2X.

The Paris Climate Protection Agreement sets politicians and society a clear target of maintaining temperature increase under 2ºC by the end of the 21st century. In this context, how do you see the future significance of hydrogen and P2X in industrial applications at the EU level?

Germany is an industrialized country with elevated energy demands and many energy-intensive industries. Yet, in spite of the significant efforts put into expanding the renewable energies portfolio, we remain in the peculiar situation of having a low supply from these sources to support entire sectors.

A quick glimpse at Germany’s power demands for the supply of everything in the chemical, steel, and automotive sectors with immediate renewable energy, shows these sources don’t produce sufficient electricity yet.

Therefore, when announcing that “We have the goal of becoming climate-neutral”—a target that VDMA entirely supports—the message must be clear and state that other carriers, besides renewable energies, should take part too.

When you say "other carriers," what exactly do you mean? Can you explain this issue in more detail?

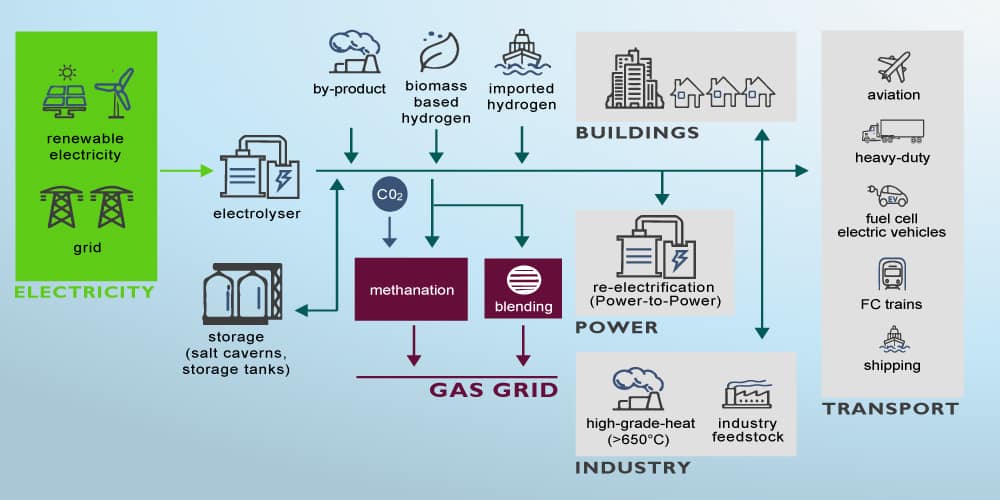

Yes, with pleasure! At this point we must be aware that our energy system consists of storable energy (molecules) and non-storable energy (electricity, electrons).

Unlike renewable energies, the new type of carriers can be stored or used as a raw material, like is the case of hydrogen and its derivatives. To illustrate it better, think of electrons. They are not usable at all in many areas, especially when it comes to the production of high temperature heat. Hydrogen has the power to change that.

So, if you look at chemicals, steel production or fertilizer production, all these sectors and areas can never be decarbonized without hydrogen.

Aviation and shipping require a different treatment. There’s work to be done with hydrogen derivatives in the future. Due to the high energy demand, a quick fix with a energy supplying batteries will not work, at least not in the long haul. Even for hydrogen itself, it is hard. Airbus is currently conducting research into the possible use of hydrogen to fuel trips. Despite their efforts, it is clear that by 2050 there will be no aircraft that can fly long distances with hydrogen.

The answer to the aviation and shipping sectors lies in synthetic fuels that are green, i.e., that do not release CO2. Hence, both are also dependent on hydrogen derivatives to drive decarbonization and ultimately enable us to continue these applications.

The EU climate package “Fit for 55” contains good approaches for achieving the ambitious climate targets by 2030. Where does the VDMA stand on this ambitious EU climate package?

The EU climate package “Fit for 55” consists of 13 legislative projects. It is a very, very large legislative package intended to make the European Union fit for achieving ambitious climate targets, such as reducing 55% CO2 emissions by 2030. A gigantic feat, bearing in mind that we already are in 2022.

It is clear to VDMA that this entire package must be seen as a whole. So, what does that mean in concrete terms? Mostly that if some measures are omitted or are not quite as ambitious, then improvements will have to be made elsewhere. A construct that is coherent in itself, but has to be implemented as a complete establishment, making the whole thing politically arduous.

Do you think the EU measures are sufficient to accompany the market ramp-up of hydrogen and its derivatives?

There are good approaches in the EU’s “Fit for 55” climate package. However, the VDMA P2X4A has already suggestions on how to make the whole climate package better, and in some cases more ambitious.

The approach of the European Union and, ultimately, of Germany is to regulate the areas in which electricity is more likely to be used, i.e., where direct electrification is more likely to be deployed and the areas where hydrogen and its derivatives are more likely to be used. This step is a strong intervention in economic life and the market.

Such analysis makes clear that the chemical industry, the steel sector, along with the shipbuilding and aviation industries cannot do without hydrogen. However, this conclusion doesn’t mean that hydrogen should be exclusive to these sectors.

In turn, it is necessary to assess other areas where it would actually be economically viable to use now, with greater incentives and willingness to pay to ultimately achieve market ramp-up.

P2X is just at the beginning of the market ramp-up. A stage where the product is significantly more expensive than when it already has a functioning market. As was the case with renewable energies when it first broke through in the market.

At this time, the European Union wants to create incentives for customers to use hydrogen in those sectors where the willingness to pay is lowest. Namely, in the steel and chemical sectors. VDMA would like to pursue a more marketable approach with a somewhat freer option, where all sectors can participate according to their willingness to pay.

How does such a proposal operate?

Creating a more inciting approach. For example, the Renewable Energy Directive (RED) II revision just introduced a proposed quota of 2.6% by 2030 for hydrogen and synthetic fuels (by default). VDMA suggests bringing that 2.6% forward to 2026 and then double it by 2030.

In addition, VDMA is somewhat critical of the fact that 50% of hydrogen use in the chemical sector should already be green by 2030. The chemical sector will not be able to pay for that. It will only work with very high subsidies. What can be done about it? Run a parallel strategy with the transport sector. We believe it has a higher willingness to pay. Especially when blended fuels are brought into the conversation. Due to the blend only a small percentage of the fuel share is more expensive, reducing financial impacts.

VDMA P2X4A also sees a higher willingness to pay in shipping and aviation, where synthetic fuels could already be stimulated to a greater extent. The shipping and aviation sectors would already be so much more advanced with the technologies. But plant manufacturers are still waiting for the investment signals to get the ball rolling. The European Union is proposing quotas, especially in the aviation sector, which seem to almost inhibit the expansion of synthetic kerosene, because it does not even remotely capture the potential of the industry. You can see how difficult it is when you want to control things on a very small scale, to really find the right degree of control in the end. The EU Commission has set out to control hydrogen and its derivatives in detail. As a large industry association, VDMA finds this approach difficult to implement in practice and rather discouraging.

VDMA supports the EU’s notion of tax CO2-based energy more heavily than renewable energy. It is a step in the right direction. However, it is vital to be frank and present in the current situation that has escalated due to the Ukraine crisis. Energy has suddenly become extremely pricey; hence, such taxation proposals, reforms of the Energy Tax Directive or a 2nd ETS, i.e., an ETS for buildings and transport, are probably not enforceable at this moment. This is unfortunate, because such impulses would be very important for the long run up to 2030.

Where do you see an urgent need for improvement and why?

We now have more or less 100 days of the so-called “traffic light coalition” with Social Democrats, Free Democrats, and the Greens at government level behind us. And these 100 days show very clearly the old wisdom that a coalition agreement is only a snapshot in time. Until the moment it is concluded, and then real life begins.

Regrettably, when the coalition agreement concluded, the extent of the Ukraine conflict could not have been foreseen. This scenario left Germany and the EU practically navigating in a completely new world.

Nevertheless, we at the VDMA were very satisfied with the coalition agreement. Now, it has become evident that the federal government is in crisis mode, and rightly so. A quick response is to react to this crisis and become less dependent on Russian gas. Which will accelerate hydrogen’s role as an “enabler.”

So, what does the German government ultimately need to address the current scenario?

For one thing, the rapid ramp-up of green hydrogen. And here, it is a valuable time to not insist on regulations that fall short. And avoid deviations, such as the classic debate on when is hydrogen green with electricity from the grid and when isn’t it. To succeed, we just have to build a fast hydrogen ramp-up and secure the transformation to hydrogen and its derivatives in industry.

The steel sector has relied heavily on blue hydrogen and natural gas as an intermediate step to green steel production based on green hydrogen. It is critical to ensure that this transformation path maintains its integrity. Green hydrogen availability in high quantities must be ensured too.

Following this approach, VDMA sees great opportunities across Europe. Remember that Germany is not able to cover the demand for green hydrogen on its own, because of the low supply of renewable energies. But, as part of an overall network joined by southern Europe, Spain, Portugal, the North Sea and the Baltic Sea (with the Dutch and the Danes) and South-Eastern Europe, there is a strong possibility to produce enough green hydrogen for the region. This concept has to be quickly matured and driven forward to achieve acceleration.

What do you think is going well?

Overall, we think good things are happening. At the moment, we are seeing a lot of activity in the area of international energy partnerships, which Germany in particular is currently pushing very strongly. One thinks of Qatar, the United Arab Emirates, and Australia as possible production countries for green hydrogen. A lot of movements are going on here right now. These positive activities must be further expanded to diversify the base of countries to trade hydrogen and derivatives with.

The counterpart is infrastructure and infrastructure expansion in Germany and Europe is still being completely neglected at the moment.

If an action to convert natural gas-based pipeline systems takes place, a step by step procedure to recall the pipelines to transport hydrogen must happen too. Infrastructure with “H2-ready” LNG terminals, hydrogen storage facilities, and transport systems for the derivatives must exist. And that’s a big issue that the German government is currently not addressing to any great extent. At least not yet.

Infrastructure and transport bottlenecks are a pressing issue. For example, if green hydrogen is available on the coast in northern Germany, there has to exist an adequate system to transport it to the centers of consumption. Otherwise, the industrial facilities in southern or southeastern Germany won’t have access to hydrogen and a huge amount of effort is lost. It’s crucial to be aware of such limiting factors.

III. PART

Building a hydrogen economy

The market ramp-up of hydrogen and P2X goes hand in hand with the construction of an economic model that sustains these arising technologies and encourages fair competitiveness across the value chain. As the opportunity presented itself, we touched ground with Dr. Kantz about the prospects of building a hydrogen economy.

Can Germany build a hydrogen economy on its own, and to what extent does EU cohesion play a role here?

As mentioned earlier, Germany has a small renewable energy offer compared to its high energy demand. Additionally, the country has few opportunities to produce green hydrogen by itself. In the eyes of the domestic market, we should be trailblazers and show that these technologies work. Become the showcase for the whole world, so to speak. But, by not being able to satisfy our domestic demand, the country can’t build a hydrogen economy on its own. As an outlet to compensate for the deficits, the German hydrogen strategy was flanked by exciting EU cooperation for a joint hydrogen strategy.

In 2020, the EU set itself the goal of building 40 gigawatts of electrolysis capacity by 2030. Plus, another 40 gigawatts of electrolysis capacity to support other countries.

Recently, the target was raised again. Another 15 million tons of green hydrogen are to be added annually. Therefore, in sum 10 million tons shall be produced in Europe and 10 million tons shall be imported, mainly from other countries. These latest additions were in reaction to the Ukraine crisis. A plan of the European Commission to accelerate independence from Russian gas.

These are all decisive goals that require us to work together with the European Union. At that, we’ve already bridged vital partnerships with Spain, Portugal, Netherlands, Denmark, and South-Eastern Europe. These regions have a phenomenal disposition for sun and wind power. The cooperation enables Germany to be a technology manufacturer for hydrogen and its derivatives while our partners act as producers. This initiative offers a unique economic opportunity for them to profit from hydrogen production.

What else goes into building an integrated (Germany-EU) hydrogen economy?

The broad value chains discussed earlier come into place once again, as countries will find emerging opportunities from the new products suitable for hydrogen use. Hence, it’s easy to foresee that new jobs will be created, and so on. A win-win situation for everyone involved!

Infrastructure is another priority to starting a hydrogen economy. If green hydrogen production takes place in Portugal or Spain, then it has to be brought to the industrial consumption centers, and for that, we need a functioning pipeline system. Otherwise, without infrastructure, there will be no hydrogen market.

Several years ago, the European gas network operators developed the so-called “European Hydrogen Backbone.” That document has the ultimate vision of a Europe-wide hydrogen partner network developed in different phases. Continuing in that path is something that really needs addressing now.

As expected, implanting a new network must also come with a set of regulations. Just like gas networks, which are heavily regulated areas, and rightfully so. Hydrogen is not exempt from this requirement. So, we need to continue working together to create fitting rules for the challenges ahead.

Building an integrated hydrogen economy requires political and regulatory clarity. It is the best way to bring investments assuredly and aligned to the technical demands.

Besides Germany, there are more than 40 countries to have developed or are developing a hydrogen strategy. Are there any pioneers?

Even if we Germans are not the fastest, we can count ourselves among the pioneers here, along with France.

What risks do you see for Germany?

The risk for Germany comes from the fact that it always wants to do everything 100 percent. So, we plan everything down to the last detail, even from a political point of view. Another risk is that we have to discuss a lot about a topic before we actually implement anything in practice. This is also the case with hydrogen and its derivative. These are some examples from recent discussions:

- The questions on the true nature of green hydrogen are fully challenging. Some claim that hydrogen can’t be green at all if it was produced from electricity from the grid with the current electricity mix, which has few renewable energies in it. According to this appreciation, green hydrogen is actually gray.

- Similarly, in synthetic kerosene questions are being raised. For instance, where does the CO2 come from? Does it have to come from the air right from the start? Could CO2 emissions be re-used from industrial plants?

There is a lot of discussion here, some of it very excited and emotional.

And I notice that we are not giving a young technology the opportunity to develop. Instead, a specific path is being forced. In the case of hydrogen, the uses have been restricted, detailing where it isn’t allowed. For example, hydrogen must not be used in road traffic or as an e-fuel for passenger cars. Hydrogen must fulfill certain conditions in advance to be green and to make matters worse, hydrogen must be used where it is currently most expensive for the user.

Such debates waste time. For that reason, VDMA recommends putting efforts into the market and the willingness to pay. An ideal scenario would have been to give this technology a set of wings to uncover everything it can achieve for humanity. Unfortunately, it’s not the case.

And the Ukraine crisis has given new weight to the issue of hydrogen and the associated independence from Russian gas. In the past, the importance of hydrogen was measured by climate policy. Today it’s a strategic issue of supply security. That means there is real urgency here to make decisions quickly.

And at this point I would like to emphasize an important point that we all need to be clear about:

Decisions made throughout this year to accelerate the market ramp-up for hydrogen and the derivatives, won’t see their fruits until the mid-2020s at the earliest. Anything we do not decide this year, and it is already March, will bring rewards even later.

What potentials do they see for Germany? How can we use this to our advantage?

There is great potential for us. As a technologically advanced country, of course, we have a rich machine and plant engineering sector. We are currently one of the leaders in technology concerning efficient electrolysis plants.

Few countries are as advanced as Germany in synthetic fuels production for industries like aviation.

Our steel industry has extremely ambitious decarbonization targets, with very complex technologies that will lead to green steel.

All of this is fantastic for a technologically advanced country. But it requires the intervention of many component manufacturers. So, companies have to innovate and reinvent themselves because certain technologies will go away or no longer be needed. The upcoming picture is utterly welcoming to component manufacturers.

Another great potential is that the German mechanical and plant engineering industry, which is an export-oriented sector, can take the other countries with it on this path to the hydrogen economy.

We can choose the green areas and show where hydrogen has importance. Our leadership allows us to be the ones dictating the terms to provide hydrogen/derivatives tech. This is something we should definitely take advantage of as it presents an unmatched export opportunity. Politicians should also throw their weight heavily into the ring.

IV. PART

Involvement of the mechanical & plant engineering sector

New and grand developments such as those embarked on creating a hydrogen route across Germany and the European Union benefit from the participation of operational sectors, such as mechanical and plant engineering. For insight, we asked Dr. Kantz about their involvement in the building of a hydrogen economy.

Dr. Kantz, we are nearing the end of our interview. Let’s take a look at the German mechanical and plant engineering sector. What can companies from this sector do to help build a hydrogen economy?

They can do so much! Companies can drive innovation, for one thing. Increase network with other companies.

When thinking in terms of value chains, smaller mechanical and plant engineering companies see hydrogen and P2X as new door to reposition themselves in the market. Getting gripped with the hydrogen affairs at an early stage helps them find their new place in this hydrogen world.

Their competencies and contributions mean a lot to the P2X community.

How does VDMA assist them?

VDMA’s numerous working groups offered great assistance to the mechanical and plant engineering sector. Our research skills and technicalities, the working groups, and broad insight into international markets are reliable tools that companies can use to their benefit.

We also have an upcoming two-day “Power-to-X Conference” scheduled for September 19-20, 2022. That will be another chance to network and get closer to new potential members or teams seeking to find answers. The conference will address the topics of hydrogen production and hydrogen application in detail. Hopefully, we’ll greet many hydrogen and P2X enthusiasts there.

V. PART

Final thoughts

After such a vibrant conversation, it was compelling to ask Dr. Kantz for a contextualized summary on the importance of hydrogen and Power-to-X in industry applications. Just to cover, where are we headed? How is the next decade shaping up? Is it really going to be characterized by this market upswing of green hydrogen? So, we did! Here’s what she said regarding specific topics:

On scalability

We’re just at the beginning of a turnaround that’s just starting now. Soon we will see a transition from electrolyzers, which are in the lower megawatt range right now, to capacities in the gigawatt range. This development will let big plants generate large quantities of hydrogen. A breakthrough to lead to economies of scale because once electrolyzers are industrialized and massively produced, they will become significantly cheaper. A price decrease to eventually add new users.

On business potentiality

Our working group calculated that the 40 gigawatts EU target has a market size for electrolyzers and plants of more than 40 billion euros. There really is a lot of business potential here. The target sectors are aviation, shipping, chemicals, and steel.

At VDMA, we would like to see more attention paid to the transport sector, road transport that is. They are a key market that shows early signs of willingness to commit and pay.

On international trading

VDMA foresees that both hydrogen and Power-to-X will become internationally traded energy carriers. So, what was gas and oil before will be hydrogen and its derivatives in 20 years. And that is a huge upheaval of the whole energy market globally, as we know it.

Warm regards and a capital THANK YOU to Dr. Kantz, deputy managing director of the VDMA working group “Power-to-X for Applications” and expert on the topic of “Power-to-X in industrial applications.”

Your exciting and valuable insights on the topic: “Future importance of hydrogen and Power-to-X, in industrial applications at the EU level” have been extraordinary!

We are also looking forward to the queries of our audience. Please feel free to send them to us via the contact form. We will answer the questions or forward them to Dr. Kantz.

For now, I say: Take care and goodbye.

Image Source: © Alexander Limbach: 1. image & 2. image (Adobe Stock), Romolo Tavani (Adobe Stock), Matrivgraphics (Fiverr) & AS-Schneider